Til Death Do Us Part: Investing in Today vs. Investing in a Lifetime

The United States has taken quite a beating in this New Year of 2016.

Right before the East Coast was buried by a blizzard, the Dow Jones’ saw its worst opening week ever for U.S. stocks.

Once again the market leaves much of humanity wreathed with fear. My friend got a call from his brother last week, frenetically panicking to learn the name of the secret stock that would pull him out of this mess. My friend – a much wiser investor – told him to hold his horses.

Traders and short-term investors certainly feel the crunch of uncertainty, but it’s what they signed up for.

Long-term value investors know that market corrections come, but solid companies will continue to grow, both in good times and bad (because people will continue to demand the supply of certain products, both in good times and bad). That’s why sticking to your plan and having a coach who can hold you accountable are tantamount in situations like this.

Because the stories vs. statistics studies that examine memory after presentations show that an image will far outlast the mind’s retention of a bullet point, I would like to illustrate my point with a story that recently landed in my email inbox.

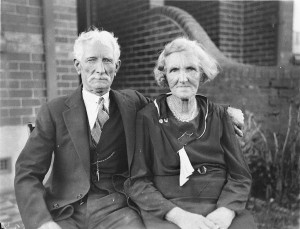

Ryan and Joanna Trautman decided to go through with their wedding in the middle of the above-mentioned East Coast blizzard on January 23, 2016. Family and friends had to wake up early to help shovel, some services were canceled, and only half of the 120 invited guests were able to attend because of weather conditions. Both the bride and groom admitted that it made for a magical experience, but what I like most about the story is that it reminds us that a wedding lasts a day; a marriage can last a lifetime.

If a day outweighs your lifetime, then you’ll certainly want to move the date.

But if you’re focused on growing old with that significant other, you know what’s most important.

In my next post, I will be focusing on transforming defensive fear into offensive confidence and finding opportunities in bearish markets. (Ex. Canadians are angry about the drop in value of their dollar, while other fellow Canucks are dedicating more of their time to freelance content management, writing, and translating work to earn American dollars).